In today’s generation, where financial literacy and security are of great importance, credit score apps have emerged as valuable tools for individuals to monitor and manage their financial health. It could be useful if you’re applying for a loan or have any personal financial requirements. These apps offer ways to track credit scores, credit history and gain insights into your economic well-being, all from your smartphone. Credit score apps have revolutionized credit tracking and made it easy for users.

Users can now keep track of changes, identify potential credit improvements, and get suited advice for improving their credit profiles. So, to help you easily monitor your credit score, we have curated a list of the top 9 credit score apps to guide you in maintaining a good credit score.

Our List of Top 9 Credit Score Apps:

- Credit Karma: Best for viewing your credit scores, reports and insights.

- Mint: Best for tracking financial budget and money managing.

- WalletHub: Best for helping consumers reach top financial fitness.

- NerdWallet: Best for educating you on financial literacy.

- YNAB: Best for creating and sticking to a budget.

- Pave: Best for improving your credit usage.

- CreditWise: Best for monitoring your credit score.

- Credit Sesame: Best for providing tools for personal financial management.

- myFICO: Best for monitoring your credit score and identifying theft monitoring.

Top 9 Credit Scores Analyzed in Detail

Credit Karma

- Pricing: Free.

- Top Features: Free credit score and reports, credit monitoring and alerts, credit score simulator, and financial education resources.

Credit Karma gives you updates on your credit scores daily while giving personalized recommendations for you to improve your credit score. The best part, you can check your credit score for free. Credit Karma also provides useful tools, such as a credit score simulator, a mortgage refinance calculator, and more. Regarding your security, Credit Karma provides theft prevention tools, including theft protection, which keeps track of any unusual activity involving users’ personal information. The app is very keen on providing financial education to its users.

Why we picked it?

We picked Credit Karma as it offers you multiple features based on your needs and preferences. It provides free access to your credit score and reports from major credit bureaus, allowing you to monitor your credit score easily.

Pros

- Providing daily scores from 2 credit bureaus

- Gives free credit card snapshots

- Credit builder

Cons

- Financial product suggestions that aren’t required

Our verdict

Credit Karma offers an easy way to monitor your credit score. They provide various resources to learn more about financial information. The app alerts users, which helps them stay informed about changes in their credit reports, allowing them to make better financial decisions if needed. In our opinion, it’s one of the best free credit score apps.

Mint

- Pricing: $4.99 (Free version available).

- Top Features: Available on the web and app with better security features and comes with a free version.

Along with a web-based platform accessed through web browsers, Mint is accessible as a mobile app for iOS and Android smartphones. It comes with bank-level security features that protect the users’ financial information by using end-to-end encryption to secure data transmission. Its user-friendly interface makes it easy to check your credit score. The app provides insights into users’ progress toward improving their credit scores and offers suggestions on improving them.

Why we picked it?

Mint allows you to connect your bank account, credit cards, loans, and other financial accounts. The app systematically categorizes transactions with a breakdown of where all the money is spent—allowing you to manage your expenses more smartly.

Pros

- Free version available

- Multiple financial features

- Useful tracking tools

Cons

- The mobile app can be improved

- Some features are included in the paid version

Our verdict

Using Mint allows you to create custom budgets for various spending categories, such as transportation, groceries, and entertainment. Every time you exceed the budget limit, it would send you alerts and reminders. Set financial goals using Mint, such as saving up to buy a car, paying off debts, or building emergency funds. All-in-all, it’s a great platform to track and manage your financial health.

WalletHub

- Pricing: Free.

- Top Features: WalletHub answers, credit card comparison and recommendations, identity theft protection and budgeting tools.

WalletHub is a personal finance platform offering financial tools and resources to help you make better monetary decisions. With WalletHub, you can track your credit history and manage money efficiently. WalletHub offers features like WalletLiteracy Quiz and financial fitness tools, which provide users with credit reports and monitoring. It also offers personalized advice and insights based on customers’ financial information to help them choose credit cards, loans, and other products to improve their financial situation.

Why we picked it?

WalletHub lets you track changes in your credit scores over time and receive insights into factors influencing your credit health. You can use this app to find differences, recognize potential improvements, and take action to enhance your credit profiles. It allows you to ask questions about personal finance topics and gives you answers from WalletHub’s community of experts and knowledgeable users.

Pros

- Free to use

- Detailed financial product profiles

- Trustworthy reviews on financial products

- Targeted recommendation

Cons

- Hard to find some required features

- Cannot import financial transactions

Our verdict

WalletHub’s free credit score simulator allows you to experiment with different financial scenarios to see how specific actions may have an impact on your credit card score. Its CardAdvisor feature helps you find credit cards that match your credit profile and spending habits. WalletHub aims to provide individuals with the knowledge and resources to manage their money and achieve financial objectives.

NerdWallet

- Pricing: Free.

- Top Features: Financial calculators, insurance comparison, investment and retirement guidance, personal loan and mortgage comparison.

NerdWallet provides its consumers and small businesses with the right tools, insights, and information to make the right financial decisions. It gives you the required data on your credit score, allowing you to track it occasionally and simultaneously providing information to improve your financial literacy. It is a popular choice for people looking to increase their financial literacy and make informed financial decisions regarding their credit because of its user-friendly approach.

Why we picked it?

NerdWallet teaches you more about your credit score, allowing you to track and maintain it simultaneously. This app has developed a reputable source for financial advice and products. It provides unbiased and expert opinions, expanding your knowledge of financial products and decisions.

Pros

- Free to use

- Imports financial transactions

- Financial literacy resources

- Checks credit score, net worth, and cash flow

- Minimal in-app advertisements

Cons

- It doesn’t allow you to create your budget

- Little editorial content is available on the mobile app

Our verdict

NerdWallet’s user-friendly interface allows you to easily navigate various features, resources, and recommendations. Its web and mobile app platform will enable you to access your credit score on the go, wherever and whenever you need to, without any hassles.

YNAB

- Pricing: Starts at $14.99 (Free trial available).

- Top Features: Debt paydown features, goal setting and tracking, interactive budget dashboard and rule-based budgeting philosophy.

YNAB is an American-based personal budgeting app that stands for “You Need A Budget.” This website’s financial program was developed with the idea that every dollar you expect to make has to be spent on something, so you either spend the money or save it. YNAB provides information on how you can improve your credit score. While the software might be challenging initially, it becomes significantly more straightforward with use. YNAB increases your chances of sticking to a budget by helping you better understand your spending and saving patterns.

Why we picked it?

It provides educational tools, tutorials, and videos to help users understand financial ideas, budgeting concepts, and how to make the most of the YNAB platform. YNAB gives you a manual option to protect your information if you don’t want to provide the software with access to your account login details.

Pros

- Multiple bank connection options

- Various tutorials and instructions

Cons

- Relatively pricey

- It takes a while to understand the app

Our verdict

YNAB offers multiple features to help you manage your finances, create effective budgets, and work towards your financial goals. With the support of YNAB’s exclusive budgeting methods, these tools are meant to help you take control of your finances, develop good financial habits, and work toward your financial goals.

Pave

- Pricing: Starts at $3.99 (Free version available).

- Top Features: Personalized financial coaching, credit-building tools, savings goals and access to credit lines.

Pave is a financial, technological platform that aims to find financial solutions to help individuals build credit and improve their economic well-being. Pave mainly focuses on offering credit-building products and services to individuals looking to establish or improve their credit histories. They aim at providing accessible credit options and financial and educational resources to help you manage your finances responsibly and work towards achieving your financial goals.

Why we picked it?

Pave offers personalized financial coaching to help you understand your financial situation, set goals, and create plans to manage your money, save, and build credit. It also offers credit-building credit cards designed to help you develop a positive credit history.

Pros

- It helps to improve your credit score

- Good budgeting features

- Features are tailored to work with your financial needs

Cons

- No longer offers loans

- The overall experience could be smoother

Our verdict

It is crucial to understand that Pave’s features can be distinguished by their unique services and products, offering various options tailored to meet diverse needs. Pave offers guidance in every step to improve your credit score. It may provide access to credit lines or products that can help you manage your expenses and build credit.

CreditWise

- Pricing: Free.

- Top Features: No impact on credit, score factors analysis and credit score simulator.

Capital One is a well-known financial company that offers CreditWise, a free credit monitoring service. It is intended to assist people in keeping track of their credit profiles, keeping track of modifications to their credit reports, and staying informed about the state of their credit in general. We found CreditWise reliable in monitoring your credit score and providing insights. CreditWise is also one of the most accurate credit score apps.

Why we picked it?

TransUnion credit score can be monitored with the help of CreditWise in case any changes or updates have to be made. CreditWise allows you to track your credit score to monitor changes over the course of time. The special feature that makes this stand out is that it will enable you to watch the dark web, ensuring your personal information isn’t sold or traded online.

Pros

- Free credit score monitoring

- Alert messages

- Suggestions to improve credit score

Cons

- Does not use FICO

- Does not track Equifax

Our verdict

By using CreditWise, you can take control of your credit health, gain insight into your spending habits, and work to raise your credit score gradually. CreditWise can quickly address any room for financial improvement so that necessary actions can be taken in time.

Credit Sesame

- Pricing: Free.

- Top Features: Credit education, financial goal setting, basic credit reports, credit score tracking and premium personal finance services.

Credit Sesame is a platform for financial management that provides many tools and services to assist people in keeping track of and managing their credit and overall financial health. It mainly focuses on giving users access to their credit scores, credit reports, and various tools that will help improve their credit standing. Although Credit Sesame provides free access to many of its services, it also offers upgraded or premium versions that cost extra but have more features and benefits.

Why we picked it?

Numerous features provided by Credit Sesame allow you to check and regularly monitor your credit score from any location. It lays out all the information on your debts and helps you understand it better. Credit Sesame offers you the necessary features that help you in increasing your credit score.

Pros

- Free subscription

- Rent payment reporting

- Debt analysis

Cons

- All features aren’t available on the free version

- Lacks calculators and other tools

Our verdict

Users may benefit from Credit Sesame’s services for various reasons, including the fact that they can help people manage their credit and overall financial health. While Credit Sesame may offer many advantages and benefits, users should think about comparing different options for their financial management requirements.

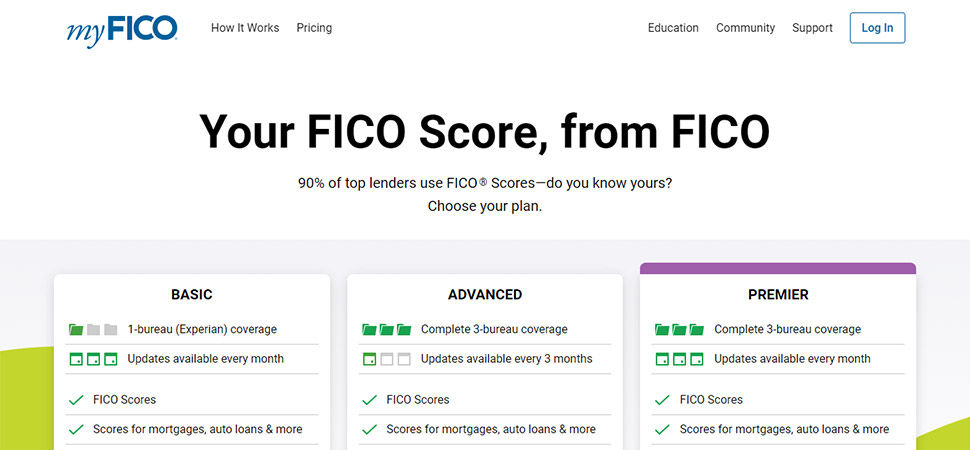

myFICO

- Pricing: Starts at $19.95 (Free version available).

- Top Features: FICO scores, credit score goals, credit monitoring plans and credit monitoring alerts.

Fair Isaac Corporation has provided a service called myFICO, which offers credit scoring and risk assessment abilities. People can access their FICO credit scores and other credit-related data through myFICO. Lenders and financial institutions frequently use FICO scores to assess an individual’s worth when considering applications for loans, credit cards, mortgages, and other financial products.

Why we picked it?

myFICO offers a wide range of features, one being FICO scores. Your credit history and other aspects of your financial behavior are used to calculate your FICO score. Through myFICO, you can view your credit reports from the three main credit bureaus. Reviewing your credit reports allows you to check for inaccuracies and understand your credit history. It is one of the best credit score apps for users to maintain a healthy credit score.

Pros

- Reliable data

- Can be customized

- Tips and training

Cons

- High pricing

- Could provide faster reporting

Our verdict

Using myFICO could benefit you if you have a deeper understanding of credit health and take proactive steps to improve your financial well-being. myFICO provides an analysis of your credit scores and offers insights into the factors influencing your scores.

Conclusion

Using credit score apps can be very helpful for people who want to keep their credit in excellent condition and make wise financial decisions. With instant access to credit scores, alerts that notify of any changes, and a thorough view of credit behaviors, these apps offer a user-friendly entry point to essential credit information. Credit score apps give users the tools they need to navigate their financial status more skillfully, encouraging better financial planning, reaching financial goals, and ultimately gaining better financial literacy.

Latest Articles

-

Top 9 Ways To Reduce Stress in Your Daily Life

January 19, 2024

-

Top 9 Walmart Black Friday Beauty Products Deals

November 23, 2023

-

Liquid Web Hosting Review in Detail

October 25, 2023

-

AppSumo Review – What is AppSumo, Lifetime Deals & Tips

October 23, 2023

-

Top 9 Mental Health Apps for Meditation and Mindfulness

October 20, 2023